For more information on Devaluation, see Publication 946. NOTE: This is a guide on entering Rental Property on a Schedule E in the Tax, Slayer Pro program. This is not meant as tax advice.:. Take Form 1099 that you got from the IRS and detail the gross sale of the property in Schedule D of the form. Your gross amount needs to be the worth of the sale of the timeshare prior to deducting costs such as commissions, advertising and closing costs you incurred in the sale. Take your earnings returns form and fill out the reference variety of the Schedule D in your Form 1099. Get in the very same amount of gross income of the timeshare that you entered in Schedule D in your earnings tax return. Deduct the expenses such as commissions, advertising and closing expenses you sustained in the sale from the gross amount of sale to reveal the net loss that you have actually incurred.

You can either publish a comparable figure to offset the loss figure to absolutely no or leave the figure as it is, considered that your week does not qualify for deductions. Take Type 1099 that you received from the Internal Revenue Service and cancel timeshare letter complete the gross sale of the property in Schedule D of the kind. Your gross amount should be the worth of the sale of the timeshare prior to subtracting expenditures such as commission, advertising and closing costs you sustained in the sale (how to avoid timeshare sales pitch wyndham bonnet creek). Take your income returns form and fill out the recommendation number of the Arrange D in your Kind 1099.

Subtract the costs such as commission, marketing and closing costs you incurred in the sale from the gross quantity of sale to reveal the bottom line that you sustained. Post this bottom line figure in your income tax return as well. Add the total worth of invoices that consist of the expense of final sale, upkeep charge over the years you owned the property, marketing costs and evaluation charges if any were carried out to get the overall tax deductions to be declared. Attach the rental invoices and other paperwork that validate that you leased the home for not less than a month or documentation that shows your intent to rent the property, for instance advertisement invoices.

As your timeshare costs grow, you may be questioning how all of it fits into your tax photo - how to get out of my timeshare tx. The bright side is that some of your timeshare costs are tax deductible. But others are not. To be sure you understand what can and can't be composed off, let's break down the legal tax reductions for your timeshare. Perhaps the only thing you ever got out of your timeshare was an annual week someplace beautiful and a break from all your difficulties. But if you resemble many owners, you probably wound up obtaining money to get a timeshare in the first place. And let's be honestit's hard to take pleasure in the beach when you're drowning in debt.

Some Ideas on How Much Does A Club Wyndham Timeshare Cost You Should Know

Nevertheless. Here's something to lighten the load a little: If your timeshare loan is secured, the interest you paid on it will usually be tax deductible! But what does "secured" suggest? In case you do not understand the difference from the http://simonhwly063.raidersfanteamshop.com/a-biased-view-of-where-to-see-wyndham-timeshare-presentation original purchase loan, a protected loan is either: A home equity loan you borrow versus your main home to finance a timeshare, or. A loan that uses your deeded timeshare week as the security, or collateral, for the loan. If you have actually a protected loan for your timeshare, you can compose the interest off. We never ever suggest financial obligation, however if your loan is protected, you can at least ease a bit of the financial pain by crossing out the interest.

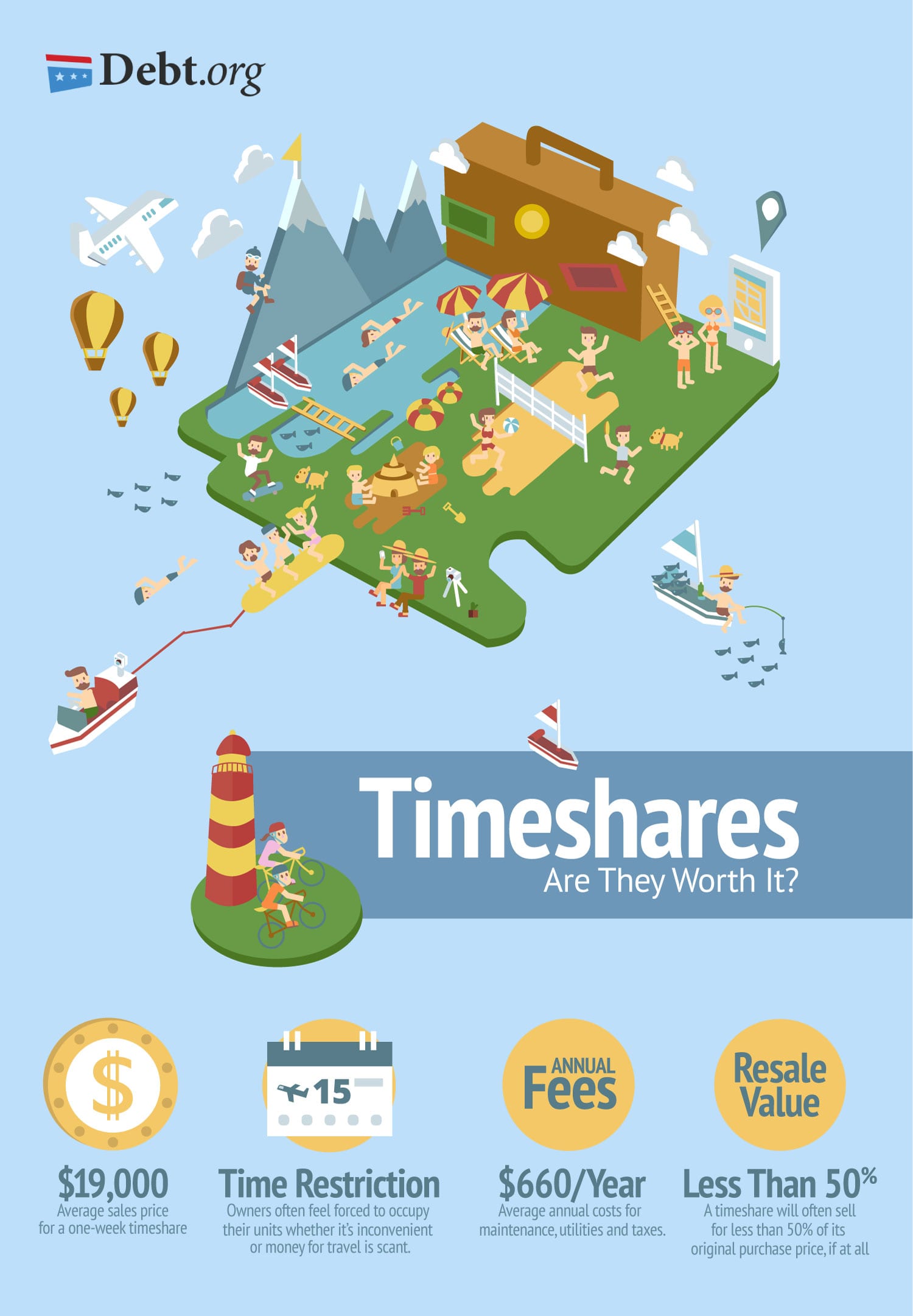

( Naturally there is.) You will not normally be able to subtract the interest paid if your timeshare week is through a long-term lease, also called a "right-to-use" or "points-based" plan. To ensure you'll have the ability to make the most of this deduction when filing, make certain your deeded week appears in the loan file as the security for the loan. If it doesn't, be Go to the website prepared to get a file from the seller clearly mentioning that your deeded week is the loan's security. Sorry to say, your maintenance charges are not deductible. The resort where you have a timeshare utilizes these costs to pay for everything from landscaping to amenities and business costs, and the typical yearly cost is around $1,000.1 In case you haven't observed, fees tend to rise by 5% a year.

There is one tax exception for maintenance charges. You can compose them off if, and just if, you paid them while renting the timeshare to other individuals. Yes, you can get a reduction from the home taxes you pay on your timeshare. Just make certain you follow the rules to make it stick: The taxes examined need to be different from any upkeep charges (the 2 are in some cases lumped together in timeshare costs). You may require to ask for a detailed declaration from your timeshare management to prove you paid real estate tax. Note that the residential or commercial property tax on your timeshare might be examined to the whole resort, or as part of a tax parcel larger than your individual share.